- 12 Of The Proven Online Gaming Benefits To Support Young Players - March 27, 2023

- 8 Signs You’ve Been a Victim of Love at First Sight - September 18, 2022

- 4 Perfect Tools To Measure Your Blogging Goals - August 23, 2022

Welcome Everyone.

Thank you all for joining today’s Leading Through Crisis program, the effects of COVID-19 on real estate markets. It is my pleasure to introduce today’s topic.

I explore issues in real estate finance, securities, and mortgage markets, financial intermediation and banking, market structure and regulation, and housing policy.

Inefficiencies in credit markets, financial technology, shadow banking, financial regulation, mortgage market reform, and the impact of consumer credit markets on the broader economy.

Outline

People are worried about buying real estate, and Mortgage Calculator is here for those who are worried. They have a feature that allows you to link to a specific calculation with the results already filled in.

They provide additional calculators which have features like:

1. Estimating Mortgage Affordability Based on Income.

2. Printable Amortisation Schedules.

3. Loan Overpayments.

4. Remortgage. 5. Payment Calculator.

So let’s just get going. Let me give you a little bit of an outline of what I would like to talk about today. So first of all, if you think about the impact of COVID-19 on real estate markets, they’re really two critical factors that play a role here.

One is the evolution and persistence of the pandemic itself, and I’m not gonna talk much about that. You know, like if you think about Spanish flu, for example, it has been a very different pandemic in a very different economy. So as a result of that, you know, it’s a big factor of it is really generating significant assets they need to going forward.

What I will emphasize of all, the second stock sort of it critically impacts the severity of the pandemic and its impact on the economy, including real estate markets is the nature of the policy response. So I’ll emphasize that when you try to predict, you know, what’s going to happen to the economy, the real estate markets, in particular, you really also take a stand on what’s going to happen to the policy response.

Great Recession

So Let’s talk about the Great Recession and Lessons from the Great Recession and I will try to make a point that this lesson is very important to inform the current policy response. In some sense, if you think about the response to the Great Recession, what it did, it helps you predict what administration and Congress are likely to do going forward, and you can draw some sort of implications from that.

Once I do that, once I briefly talk about the Great Recession, I will tell you what was the policy response, policy response to COVID-19 emphasizing also the elements that affect real estate capital markets and how sort of it differs and compares to the policy response to Great Recession.

Then I’m gonna spend time discussing the impact of COVID-19 on residential real estate, both housing and mortgage markets. Then we’re going to move to the impacts on commercial real estate. And then I will conclude with some broader thoughts and speculations and the long-term impact of COVID-19.

So first let me talk briefly, spend a few minutes on the Great Recession. This is the last crisis we had. It starts at roughly around 2007. We know we have millions of foreclosures. We have a very significant loss of output, and there has been a very significant set of stimulus measures implemented during the Great Recession to help stimulate the economy and real estate markets, especially the housing market in particular.

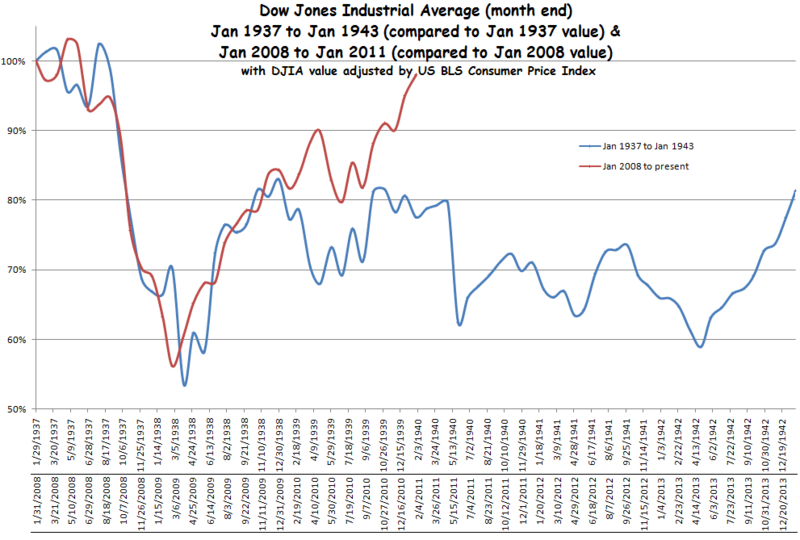

Just to show you what happened during in Great Recession we had a very big drop similar to the drop that happened in March in early on during COVID-19, during the initial stage of the COVID-19 pandemic in the U.S and there was subsequent recovery.

One thing I want to emphasize, if you look at the recovery from the Great Recession, it took quite some time just looking at the stock prices, took about five years for S&P 500 to really recover to that pre-crisis, Great Recession level. And in response to the Great Recession, we had a string of body stimulus measures implemented.

I want to emphasize two things. First, the various rounds of quantitative easing. What you see is a decline in interest rates to a very low level. And also you had specific programs aimed at stimulating real estate markets, especially the housing market, Home Affordable Modification Program.

When government-paid services modify loans and home affordable refinancing programs. When, essentially it was allowed for people with very little housing equity to refinance the debt, to take advantage of these low rates. And one thing I wanted to stress is these measures were not implemented immediately. And in fact, there’s some policy delay in making them work.

So for example, initially Home Affordable refinancing program, which was implemented in March 2009 was really only applicable to people with loan-to-value ratios less than 125%. So if you really suffer the big collapse in house prices, you couldn’t take advantage of that. And it took Congress and administration about three years to fix it.

So we can see a very significant policy delay. And one nation of Great Recession, and this is why we worry about COVID-19 pandemic is the recovery from the Great Recession was really, really slow.

So for example, the market is defaulted to almost four years for the mortgage default to get back to normal. And in fact, only 74% of regions recovered. And if you look for example, at house prices by 2017 house prices will become not only in about half of the US zip codes, and it took those zip codes to recover it took about five years to get there. And same about the recovery of auto consumption here, measured by auto purchases, and the same about the recovery of employment.

So, one thing that I want you to remember is similar to what we see in the recovery of an S&P 500, the recovery from the Great Recession took many years. And that’s why, you know, in particular of COVID-19, there’s an obvious concern that we have initial shock, but it might take a lot of time to get back to normal.

This just, for example, shows you that the red areas are areas that haven’t recovered consumption from the Great Recession by 2016. So we see also recovery was very uneven and, you know, just to kind of sum up the effects of Great Recession, we have about 10% of households with debt lost homes.

So we have foreclosures in the order of, and six medium and a significant cost of foreclosures. You know, most borrowers that lost homes to foreclosure have to move to another area. Only about a quarter of borrowers regained homeownership, taking about four years on average to do so. Of course, foreclosures are also associated with a very significant decline in borrower creditworthiness.

That can affect the ability to, you know, obtain new credits, to spend. And more fundamentally we worry about crises and in particular, think about COVID-19 the initial worry was if we end up repeating the Great Recession and we end up repeating waves of foreclosures, foreclosures have significant deadweight costs.

Just to give you an example, the home in the middle went into foreclosure in 2009, this is when the lender repossessed in 2012. So this kind of a working out through the debt crisis economic recession, the foreclosures can have very significant costs.

So why recovery from the Great Recession was so slow despite these value stimulus measures? And it’s important to think about it because this kind of a lesson from the Great Recession I think really importantly informed what the Congress and administration are doing nowadays.

So first of all, when the Great Recession had lower rates, only a few borrowers benefited directly because most of the contracts are fixed-rate mortgages. Only folks with ARM get immediate debt relief. Now, of course, another way to take advantage of low rates like we right now during the COVID-19 pandemic is to refinance your loans, but it was hard to do it because of various refinancing constraints.

If you have negative equity or lost a job it was hard to refinance. The home authority was refinancing program party elevated it, but it was not really as successful because of various delays in fixing it, that we make a point. But this program was championed by Glenn Hubbard and Chris Mayer from Columbia.

So I view him as one of the founding fathers of this policy which helped about 3 million households regain essentially lower the cost of the debt. Besides, banks didna have limited incentives to work outlaws, they did it now. And again, Home Affordable Modification Program brought reality to it.

But also, a lot of financial institutions didn’t really have the capacity to offer help as it relates to households because of a lot of use institutional frictions. And a simple assessment is that this frictions count is called about 50% of crisis, more than 50% of crisis severity.

In other words, if you look at the Great Recession and even taking the initial shock has given the type of risky, that was there, the crisis will be about 50%, at least 50% less severe if the policy response was better to the, in this. And of course, another thing is the areas that get more help, more that’s more debt relief, more liquidity support recover much faster, especially just shows you the change in the growth out of auto consumption.

It’s a measure of durable spending, and you can see that areas that get more debt relief quicker response with interest rates recover faster than areas that did not. And I want to stress this affects where we reposition.

So the last side on Great Recession, it kind of the bottom line lesson from this is the importance of temporary house with liquidity support and definitely for recovery, really two broadways to implement it. We already had unemployment insurance with the place.

Some of these roles, alternatively, we could consider some sort of state contingencies build up in providing house calls, desperately doing crisis. Also, you can use these export stabilization programs like HARP and HUD or the CARES Act that was passed in response to pandemics.

The issue is with one thing you have to keep in mind, you really cannot really fully rely on the private sector for implementation of these policies. And of course, you need to think about what kind of frictions you try to solve. You know, usually, we think about that with the cost of foreclosures.

There could be some demand externalities. There could be some marketing completeness. You have to take into account the impact of this policy, some incentives to repay that, to find work. And they brought the broader consequences, you know, think about space, scale, stability, long-term impact on inflation, and so on.

COVID-19 and Policy Response

So let me know, move to the COVID-19 and policy response. The one thing I want to emphasize first that the policy response to COVID-19 was really very aggressive. It’s like, what was that in the Great Recession, but on steroids. So I think there are lessons that we have to act quickly and decisively, and in some sense, we have to avoid, you know, working for the private sector has been kind of learned and implemented.

So just to show you the timeline of response to COVID-19, we have a national emergency declared by President Trump on March 13. Very quickly that saying within literally two days, you have to slash rates to virtually zero.

Eventual another round of quantitative easing and very important policy CARES Act signed by President Trump on March 27. I’m gonna talk about it because it importantly affects what’s happening in the real estate markets. And then, you know, there are some provisions of this program recently expired.

There is kind of a bit of a grid block in Congress, negotiation, of course, affected by the time in the collection. So President Trump issued to recently this executive order trying to prolong some of the stimulus measures implemented in the CARES Act.

CARES Act

So CARES Act is a multi-trillion program. And one thing I want to emphasize in terms of its impact on real estate markets is a bunch of things. So first of all, you have significant financial assistance to businesses. You have this 1/2 trillion-dollar lending program to feed them.

You have a Paycheck Protection Program that helps essentially small businesses employ their workers. But a very important element of the CARES Act is a very generous unemployment benefits support. In addition to regular unemployment benefits and unemployed working candidates, can get $600 per week until of course it expires expired in July 2020, by the end of July. So just to give you a sense, there’s a $600 recent study from JP Morgan chase, find out that 70, more than 70% unemployed, but actually making more money while being employed when in the prior jobs.

Why this is important, of course, such a level of stimulus, in some sense, a more, limited impact, or limiting this impact of real estate. Think about paying mortgages. If 70% of our employees actually can effectively make more money than before.

They’re not necessarily going to start missing in mass payments on their mortgages, and so on. And besides, this program has really a lot of measures that were meant to help with, you know, preventing foreclosures in particular, if you have a government-backed mortgage. It’s about 2/3 of the total, there was a suspension of foreclosure actions on these loans.

Moreover, you can get up to two years worth of mortgage forbearance. If you are a renter in a multi-family property that’s financed, for example, with GSE-backed loans, there was essentially 120 days eviction or moratorium on evictions for renters.

And these policies were reinforced with additional state and local moratoria. So one thing I just want to emphasize, a lot of initial effects of COVID-19 kind of noticed something you would expect because of this extremely aggressive policy response and what we want to, you know, if we think about predicting the longer-term impact of the real estate market’s rule, you would have to think about what, how the policy will evolve going forward. So this is just what Fed also did, you know, Fed took a trillion-dollar amount of liquidity in a matter of literally five weeks.

And that essentially, and in addition to the market, developments resulted in an insignificant decline in long-term raise. So the treasury right now, 10-year treasury is around 60 basis points, which is really very, a very low level by historical standards.

Impact of COVID-19 on Housing Finance Market Real Estate

So let me start first by talking about the impact of COVID-19 on the housing finance market. And I’ll start by saying, by showing you some simulations we did on the impact on the residential mortgage market within these simulations early on, just when the COVID pandemic was starting.

And just to give you a bit of sense, how big the residential mortgage market is, we had about $11 trillion of debt, outstanding. Why it’s big? It’s smaller as a proportion of GDP when viewing the Great Recession. So in 2007, about $11 trillion was more than 70% GDP.

Now it’s about a half. In essence, the residential then become a less important part of the economy in proportion to the economic activity, but it’s still very, very important. So what we did first, we just we’ve made colleagues with some simulations on what’s going to happen to the residential real estate market, especially residential lending markets in response to the COVID-19.

So we began owning doing these projections is what’s going to happen to house prices, just to give you a sense, you know, that the leading companies are somewhat pleased.

Zillow is more optimistic. They predict about two to 3% decline. Core Logic in some predictions goes to a six to 7% decline. Obviously, the impact of unemployment is very different, than in the past, and we have this great quick and aggressive policy response.

It’s far more complicated inferring from past data what the impact of COVID-19 will be on residential real estate markets. So what we did with my colleagues, I don’t want to bother you with too many technical details, but we essentially think about is a big statistic, a big data exercise.

We have essentially very detailed data on every single loan in the U.S. tracked for more than a decade. We have actually almost two decades of data. And we take advantage of the fact that he started in the U.S., you know, there’s a lot of heterogeneity across regions.

You have regions when house prices go up and there is employment, places when having a lot of unemployment, but none as big drops in house prices. Of course, all these things are erogenous.

So you have to be careful about inferring something about the statistical applications from the past, but essentially kind of a big data statistical model that allows us to make predictions based on the historical performance of borrowers in various regions.

One thing I want to importantly stress is corrected and controls for the fact that the risk of the market, the risk of the debt market is changing. So even the same shop in 2007 will have very different impacts in 2020 because the nature of the borrower’s leverage is very different now than it was in the past.

So I just first want to show you some quick simulations from this. And again, remember we have done it. You know, we adopted essentially some framework, which we’ve already developed for these scenarios. We did it partly to show it to some people in policy circles.

We assume initially that was that in March marginally after to was for, you know, the recovery will take by 2021. And these a lovely scenarios in terms of how unemployment will evolve. And we do two types of scenarios.

One when we have when we assume house prices don’t change. And another one, this is, by the way, the unemployment during the Great Recession. And another one when house prices change.

So by about the third month of the pandemic, unemployment was about already 15%. Now it has trended downward, somewhat, and house prices have, if anything, moderated soft and nationally in some areas, they went up, in some areas they went down.

So the first thing we did, I’ll first show you a bunch of predictions when which we have done keeping the house prices constant. And essentially we find out that the delinquency level, the serious delinquency is about two to 8% of the total mortgages.

If it’s translated into foreclosures, we’ll have about a, you know, if unemployment recovered reasonably quickly, we’ll have about 1% of loans going into foreclosure. In the U.S. there are about 55 million borrowers.

So you talk about 500 to 600,000 foreclosures. Unless of course there will be a very big declining, increasing unemployment, then it can push forecloses to more of a medium. Of course, there’s a critical role in house prices.

If house prices substantially declined, it gets much worse. We’ll have about 14% of households missing payments on the mortgage for a prolonged period of time. I know that for, enough this house is about, about half will go into foreclosure, a little bit less, but half.

So they end up with a 6% foreclosure level, a little bit higher than 6%, which actually pushes us close to four million foreclosures. But for this scenario to happen, you’d have to add a big increase in unemployment and significant deterioration in house price conditions.

Note that this is still better than the Great Recession. Why this is still better, remember Great Recession had a 10% foreclosure rate and six million foreclosures as opposed to four. It’s better because of two reasons. We assumed that recovery will happen by the end of 2021.

In fact, if the recovery takes longer these effects will be pronounced. And second, the quality of loans was much better in 2020, than in 2007. So in other words, the housing market was not as risky in 2020 and 2021 as it was in 2007. So the bottom line, one thing I want you to keep in mind from this simulation, that as long as we have recovery within the next two years, it’s not gonna be on the residential mortgage market side, as bad as the Great Recession, unless house prices decline substantially.

But even then, we’re going to get to about 2/3 of the severity of Great Recessions. And losses, in this case, will be up to $250 billion. So now let me show you what actually happened in the residential housing market. So first of all, there was a very particular contractional view as GDP was really impressive back then.

The U.S. GDP in the second quarter of 2020 was contracted by about 1/3. If you compare it to the Great Recession this is really unprecedented. There is an undergoing recovery of employment, but it was still at a very high unemployment level than before.

But there are some signs, of course, that we are recovering. If you look at the recovery of consumption there had been a recovery, but has recently stalled. You can see that in June, July the consumption stopped going up.

And of course, the big question, what’s gonna happen going forward? But remember the $600 unemployment support has expired. We have Trump’s executive order which replaces it with up to $400 per person.

It’s not clear whether it will be implemented and how quickly. So if this issue is not addressed we might actually expect a drop in consumption going forward, which could of course adversely affect real estate.

So what happens in that, are investors worried about it? Remember the markets are forward-looking. It seems they are not really as worried because as of yesterday the Dow Jones Industrial Average has been only about 2.7% down relative to the beginning of the year.

Of course, some of that could be pricing expected inflation, monetary stimulus. And nevertheless remember, markets are forward-looking. And you can see there has been a significant recovery of stock prices from the kind of bottom around the late March, beginning of April.

And comparing this to the Great Recession, remember in the Great Recession took about five years for the stock market to kind of get to the place that is level. Here’s it’s really achieved that in a matter of about three, four months, almost.

What Happens in the Housing Finance Market

So what happens in the housing finance market? The key thing is that forecasts regarding house prices so far house prices have not really declined substantially. Some companies like Corelogic Forecast about 6% decline by May 2021. But again, counting back to the policy response the full effect would really depend on what’s gonna happen in terms of stimulus going forward and how quickly the unemployment will recover.

One silver lining of this market stimulus measures that were implemented, the mortgage rates are now at a historical low. You can get a 30 year fixed mortgage for as low as 2.88%. And if you have good credit you can get an even lower rate. And because of that, and remember, interest payments on your mortgages are also tax-deductible, this factor causes for some high paying taxpayers, half of that amount for real.

So this really helps and two ways. First, it makes housing much more affordable, which helps with the housing demand. And second, it stimulated a huge refinancing boom. In fact, if you look at the number of households that could benefit from refinancing if rates are 2.87 we could have 20 million households that could benefit from this refinancing rate.

That means that houses that are refinancing will have more money in their pockets and houses have significant house equity to touch. So this is positive news for the housing market. If you look at the recovery of home sales you can see that in March after there’s a big drop, this is largely because of the shutdown and essentially the real estate brokers’ market collapsed at this point.

But you can see a very robust recovery. And new pending sales are the most important indicator to lead indicator because you know it takes some time to close your home purchase.

And as in many economists, including myself to some extent were surprised by the current state of the housing market on the positive. And in fact, there’s a bunch of things going on here.

First, the market is in many places the housing market is somewhat supply constrained. There was not as much of a development boom over the last few years and have millennial generation postpone homeownership and now because of this lower rate, they’re really flocking into buying provided they have a stable job and they can afford it.

The housing market so far is going really remarkably well. If you look at the delinquency rate it was close to a historical low at the beginning of the pandemic. You might think, okay this is so good. But this masks one important factor. If you add forbearance, a significant sort of loans on the residential side are currently in forbearance taking advantage of the CARES Act provision.

Should we take forbearance we have almost between 7.5 and 8% of loans with that effectively in forbearance right now. And of this loan, this is how they’re concentrated in the U.S. The more stressed borrowers are from taking advantage of missing payments on their loans.

And of these people in forbearance, only about 20% make payments. About 80% of them don’t. And if you look at maturities some of these folks that got forbearance already get another extension there is an important wall of maturities in this forbearance in September.

So from the policy response, we’ll have more than two million borrowers that by the end of September their forbearance will expire and there’s a very big question mark what’s gonna happen to these borrowers. Are they gonna resume making payments or are they gonna default on their loans?

And just a few policy ideas for to do, several people including myself think it will be sensible to roll the missed payments, remember forbearance is not debt forgiveness. You essentially defer repayments of your principal and interest rate.

It would seem sensible to roll these principle and interest payments into your principal balance that would spread out repayment and avoid this adverse payment shock for these borrowers that could stress the housing market. We could also consider a variant of the HARP Program, essentially allow borrowers to refinance their loans regardless of the employee housing equity status.

And by September of 2020, the situation is bad. So we have increasing unemployment problems with people making these payments. We calculate it, but it will cost about $20 billion to support mortgage payments.

If the government would like to directly pay mortgages of houses for certain periods of time. Of course, then extreme measure. You’d have to think about potential adverse effects on incentives of houses to repay their debts. But it’s something that, that we should, we should keep in mind.

Commercial Real Estate Markets

Now let me move to the commercial real estate markets. So what I want you to kind of remember from this discussion we had on the residential housing market is for a moment in a reasonable good shape. The big sort of question mark is how much unemployment will keep recovering and what will happen to that policy stimulus provided to those unemployed.

If there is one area of significant risk it’s that sizable sort of loans that are in forbearance and how this forbearance will be handled when this forbearance expires. Now, let’s go to the commercial real estate market.

So first at the very beginning of the pandemic, there’s a very significant drop in the value of real estate equity. The best markets to look at it is real estate equity, the real estate investment trust market because this is a holding company is holding a portfolio of real estate assets because they are publicly traded.

What market is thinking about commercial real estate going forward? And as you can see, the drop was very substantial about 1/3 of the valuable March 19, 2020. Of course, you have to take into sight that this is not a loss of value of the properties because this is equity.

So there is leverage, but if you Unilever, so, and secondly, you have to take into account, but of course this impact varies by property type. Usually, you will expect in typical downturn things like hotels, retail to be particularly badly affected.

I think pandemic exasperate this impact because due to shutdowns and social isolation, the impact on these properties is more pronounced. So if you look on a sector by sector, residential real estate lost about a third of the value, as well as an industrial note based, but retail and lodging by March 19, 2020, lost more than half of its value in terms of the real estate equities, and lodging lost about 2/3 of the values.

Now you have to Unilever this effect to, the impact by sector when we remove the leverage. what the stock market was telling was declining the value of the properties. And you can see the biggest decline was in malls, 35%, lodging hotels 35%.

But for example, data centers, industrial real estate, did much better because, you know, they are less impacted by COVID-19. And in some sense, some of these assets are doing better because, in increasing demand for data processing, we’re currently on Zoom calling some data center is processing our Zoom call at moment.

So what’s interesting if you think about what this price tells us about the extent of the impact on commercial real estate, think about a typical property and lever, which say you bought on a multiple of 20 times cash flow. If you would just remove one year of cash flow, say it, all the pandemic means is there’s gonna be no cash flow for one year. We would expect a drop in value of about 5%.

These drops are much bigger than that, which tells you of course anybody understands as a pricing notice, it’s a combination of dividends, cash flows, and changes in this distance factors, but this drops in prices definitely prices a much more prolonged recession and potentially it’s a significant increase in risk when just six months on one year dropping a rent collection, even drop to during collection to zero.

Now, of course, there was a partial recovery. After CARES Act was passed various stimulus measures were implements and we get a better understanding of the pandemic and its effects. Residential real estate right now is down about 20%.

Office and Industry

Office and industry are down about 10% relative to the beginning of the market. But as you can see, retail and lodging haven’t really recovered. They recovered partially, but hotels, in particular, are still very adversely affected. This is where the assets pass, but suffering the most on the commercial real estate side, followed by retail assets.

I need it, it’s not very surprising that hotels have suffered tremendously. You can see that a very, very pronounced decline in revenue per available room for some hotels was a decline of up to minus 100%, essentially no income.

And this is very persistent. There hasn’t been as much recovering that, of course, in some areas, hotels will be open, but the situation is really pretty bad on the hotel space. You are familiar with this, that some four-star hotels in New York are currently acting as homeless shelters.

It just tells you from the perspective of the owners of this, which used to be well-performing assets in Manhattan, it’s now a good deal to get money from the government by helping homeless people, as opposed to trying to, you know, survive pandemic and reopen these hotels later on.

It just shows you how bad really the situation for hotels is. So New York City already had a lot of problems with hotels because of the overbuilding styles upon them they can drop in the foreign demand and Airbnb, but they’re just from then it is really a very, very significant blow to this asset space.

Retail Side

On the retail side, this is just a retail bankruptcy and closers we had by month in 2020. You know, in May, we should say kind of bye-bye to J Crew. You see Penney, you know, in July, you know, we have several other brands, but when, now I’m thinking about Brooks Brothers and others.

And because of that, of course, the retail is suffering. If you look at rent collection, this is from the real estate investment trust research. So keep in mind, this is kind of geared toward better quality properties. You see the rent collection is actually still quite good in most of the asset classes, except, of course, hotels, which are not sold here.

You know, the hotels don’t have long-term results. Hotels are doing horribly and another asset class, but that’s pretty bad, is shopping centers, but there was a recovery in May. The shopping centers on average collected about 49% of the rent by July was close to 70%.

If you look at real estate debt values those are a significant decline in debt values, this is CMBX triple B with the kind of has some good exposure to the lodging. There was increasing their spreads, which essentially is a proxy for the cost of credit if you would want to refinance or get a new loan. And more important, if you look at the commercial mortgage-backed security market, we don’t have good data on the performance of commercial on debt financing commercial real estate properties.

You see there was a very big increase in delinquency rates following the pandemic. There’s a slight decline in July 2020, but these are the levels that are very close to Great Recession levels. And who is defaulting the most? Its hotels and retail, has about a quarter of hotel loans, both salt, both commercial mortgage-backed securities are currently in default.

So this is a very, very sizable number. So not only hotels are performing very poorly on the income side, but also hotel operators are really in mass are stopping the loans, and a lot of these centers are going to call it very significant distress. If you’re generally seeing the U.S. where these delinquencies on commercial real estate loans are located you can see not for central areas, particularly badly hit.

Some areas of Southeast central, but in many other places that the delinquencies are reaching, you know, 10, 11, 12%. Of course, these delinquencies are a benefit for some folks. Blackstone on one hand has recently trying to shut down the commercial mortgage-backed security fund.

They lost 24% of the value. They were long gone commercial mortgages from the time before the pandemic. On the other hand, you have companies like KKR that raised recently significant funds actually investing this and buying distressed mortgages and distressed properties really because once in the lifetime opportunity to buy distressed assets.

And there’s a significant discussion of commercial real estate bailout. It’s really changing by Texas Republican Nick Van Taylor. And there’s some discussion in Congress about potential bailout providing some lifeline loans to operate on some commercial real estate assets.

So you know if you’re a KKR and you buy distressed risk debt and then there was a potential bailout you might actually benefit from that. But let me sort of wrap up with some sort of long-term impact of commercial real estate. So on the lodging side, the impact is really bad right now.

A quarter of hotels in CMBS are in default, and the revenue drops are horrific in many places. And the general belief is that the impact will be very very persistent. It takes time also to affect people’s beliefs. And, you know, even if, in reality, it’s not like everybody will immediately clock and stay in hotels unless we have the scene in unless we really set in that and the risk is really low.

So there’s a lot of thinking in the industry right now, how to reposition, help out. So if someone on your calls is, you know, in real estate distress or work for an opportunity fund, this is kind of the one number one asset you will be looking at buying a hotel and maybe thinking to even operate cheaply or convert it into something else, maybe converted in the homeless shelter or convert it into office, converted into maybe multifamily.

Lodging

And so the lodging is one place that I think will be harping for a prolonged period of time. The retail, the same story to large extent is about retail. If anything, the pandemic it’s just accelerated eCommerce trends.

We know that a larger, larger proportion of consumer activity is moving online. And I think there are specific places that will be more exposed to this will do substantially worse. It doesn’t mean invest some experiential retail, high-quality retail, won’t come back.

I think we still enjoy going to stores. So not everything can be bought online seamlessly. So, but, you know, I would personally expect that prolonged the impact on retail, and in some sense, you know, you sold a tremendous amount of closings and bankruptcies of retailers, such as, you know. This asset class will be harping going forward.

Office the impact is more interesting. So if you talk to office operators, the one concern is okay, telecommuting is mostly Starbucks, is working by Zoom means that, you know, a large share of the workforce will be able to work from home. And if they will be able to work from home, of course, that means less demand for space.

Suburban Offices

Besides, maybe suburban offices will be likely winners since people will maybe be more likely to live in suburbs. Maybe the office will move closer to where they live in the suburban office. Social distancing is much cheaper costs might be the kind of a winner.

In that sense, if you believe in this, you know, the commercial office space in big cities like Manhattan will be in trouble, but extends, you know, this safe cause the suburbs would not materialize. The impact of the pandemic on the office is kind of a big one.

Let me tell you what I mean. So the office trend over the last three decades was to lower the square footage per person. So typical person in the office in 1970 consumes about 600 square foot. By 2017 it was about 150. Part of that is coworking companies like WeWork.

Part of it is more open spaces, also removing the need of storing a lot of documents. So the pandemic will have kind of two effects. On one hand, if people move to suburbs some are more likely to work from home, you don’t need office space. On the other hand, if you want to keep people in office space, you may want to socially distance them better, in particular, some regulation may require you to do it.

So conditions still needing office space. You might actually need more office space per worker. In that sense some, for example, prime office spaces might benefit from that because suddenly the company that used to house X amount of workers per square foot might need more space to house the same amount of workers.

One area is I think the impact is obviously quite adverse is coworking. Think about companies like WeWork they’re really in trouble because you know, the whole concept of WeWork means packing a lot of people per square footage, as many as you can.

And obviously, pandemic social distancing and associated regulation are not helping you in this regard. Now, so we don’t exactly know which way it will evolve, but I think there’s gonna be the impact that will be quite interesting and some properties actually might do quite well, while others will not.

And it depends on whether they will be demanding central business district area for this office or not. If you think about multifamily and they’re kind of a bunch of trends here. One is the move to, one is the potential move to suburbs. That will be very big, bad news for the multifamily cities like New York, San Francisco, Seattle, or plans potentially good most for multifamily buildings, which are reasons not too dense in the suburbs.

And of course the big debate right now about the viability and future of cities. It’s also put imposed, you know, by things like the recent increase in crime, concerns about high taxation in cities. If you look at what’s going on in New York City, right now, there has been a significant increase, especially in Manhattan and Brooklyn in available rental inventory.

This sort of ties to this, what people call the sleight of people from New York City, a significant share of folks have moved out. Some of them moved out to second homes, but many of them actually move out without renewing their leases. So in that sense, you know, there is a big question like how cities like New York’s will perform.

I think it depends a lot on the quality of the guidance and policy-making coming from the mayor’s office and so on. And, you know, certainly is a lot of discussion about this right now. Industrial, I think industrial has a limited impact unless of course, we have a prolonged recession.

If anything, it could be positive for some asset classes like data centers, warehouses, that help eCommerce operate. And then kind of the last thing I want to say is, you know, there’s also this ongoing real estate tech revolution. And I think in some sense pandemic will accelerate certain trends, digitization, you know, online showings of apartments, online brokerages ability to rent by buying real estate by clicking a mouse.

Things like this will become more prominent going forward. So kind of let me leave you with kind of the summit of where we are. What’s going to happen critically depends on their sort of there, the evolution of pandemic, but also very critically depends on how the policymaking will evolve going forward.

Residential Market

Currently, the residential market is doing reasonably fine. One area of concern is a very high level of high, relatively high-level of forbearance and how they’ll be processed by the system when they expire. On the commercial real estate side, the biggest impacts are hotels and retail.

Hotels

Hotels, in particular, are really in bad shape. a large increase in delinquencies. Many of these hotels are really, might not be viable going forward. Now, of course, it’s also superimposed on geopolitical trends, declining, foreign travel, various visa restrictions, and so on.

Office

On the office, the impact is kind of more ambiguous. Mostly family depends you are. Industrial I would view a limited the impact. In fact, industrial might also benefit from some restoring of activities to the U.S. As more people are moving to suburbs, I’ve already kind of touched upon it. It’s a big real question mark.

I think there’s no doubt that in the near term places like New York City will suffer. I’ve actually tracked rent in Manhattan, and I have additional ways to see maybe things before they are reported by companies like Ferdeesy and I saw a 6% to 10% decline in rent.

Luxury Buildings

On some luxury buildings, you see 15, 20% declines in some places. So that’s certainly, and the picture that actually is currently that you see definitely shows that this impact can be quite pronounced. Why housing hasn’t crashed during the current pandemic. As I said, very aggressive policy response, but also on the supply side, the housing was relatively housing supply was somewhat constrained, and we have this millennial generation and suffered delayed homeownership, childbearing, house information is that they’re interested to buy right now.

And rock bottom interest rates have currently crashed the housing market. Some say over alleging CMBS mortgages for reason for the greater session, do you think CBS and the residential is in trouble even at this time? Or is it strong right now? The CMB, the commercial mortgage-backed security market, I was not really the cause of the Great Recession.

Mortgage

It was a more mortgage-backed security market on the residential side in particularly mortgages originated by companies like Bear Sterns, Lehman Brothers originated and underwritten that were not guaranteed by the government. We don’t have this market for you right now.

This market collapsed and never really recovered in any meaningful way. So that’s part of the reason why the housing market is in reasonably better shape right now because most of the mortgages have been guaranteed by the government.

The rest is kind of jumble and they are addressing a better credit position, have more housing equity build-up by 2020, than the loans that were in 2007. So in other words, the projections I show you didn’t have as big of the impact of unemployment on defaults.

And of course, unemployment is the key driver of mortgage, because precisely because a lot of borrowers have reasonable equity cash in, reasonable financial position to not immediately defaulting going to foreclose following unemployment.

It’s very increased. The demand for those for rent is very a movement to suburbs. We do see movement to suburbs. You can see it in a bunch of ways. One is tracking folks. The cell phone companies allow you to see people where they spend time and by some estimates about not even 400,000 people left Manhattan, quite a few of them are people that had second homes.

So they didn’t abandon manhattan as a concept. The apartment is empty, especially if they own it, but there’s increasing evidence that people are moving permanently. You know, the permanent change of address, changes of your address for tax residency. Do we think the comparison of the stock market Great Recession to the current one is really justified?

Underlying Holdings are Different

It’s a very good question. Of course, the underlying holdings are different. More importantly, the underlying stock is different. Great Recession has very different fundamental causes, but copied pandemics. So part of the reason why the stock market recovers not faster could be that we essentially have, You know, we expect pandemic to be relatively short, shorter thing.

You know, it changes things in months. So this is what I just discussed about the office. There was a question of what happens online shopping. So we kind of already addressed that regarding the financing piece, whilst that will be held, it must adversely impact banks investor.

How should we think about those dynamics for five to 10 years? Excellent point, of course, when you refinance loans, on one hand, the new loans may have a lower yield. I would say it would affect mortgage-backed security investors, but these are mainly retiree’s pension funds, which in some sense, in terms of a distributional impact, you help people who might have really liquidity needs.

You’re harming the people that might have bigger liquidity cash in, so usually from the economy-wide perspective, if your financing allows money to get to people that maybe have a higher marginal propensity to spend, it’s taking away from some retirees, wealthy, wealthy individuals, which have lower propensity to spend.

So there’s kind of redistribution of money from pensioners to younger households could actually have a positive impact on the economy. Also, you might avoid costly foreclosures, senior living sector, a great point. This sector has been quite badly affected that because of the, you know, social distance needs.

I talked to some developers and there’s a lot of thinking on redeveloping or developing new senior livings that essentially have greater social distancing. Of course, that would potentially increase the cost of this unit, which given issues with how much money recently will have to spend is a big question mark.

How are the Back Office and Retail Spaces?

There was, again, a question of the new normal reality of working from home. How are the back office and retail spaces? So we kind of already discussing it. There was a question of whether hotels to report for a certain percentage of those into small office spaces.

That’s a great idea. In fact, some hotels are already doing that and what’s nice, a typical hotel room has a bathroom. So you can have a person working, turn essentially hotel room in the office and you don’t even have to share a bathroom and so on.

New York City market, we already discussed it. There was a question on impact. I think, you know, New York City’s an interesting market. It’s very volatile in the sense it can bounce back pretty badly, but it has also shown a significant ability to recover around 9/11.

There was a talk about how bad it will be in the market recovered. I think it very important is what happens with increasing crime, with quality of services. The big problem for New York brings up, brings, brings us back to the policy response is, you know, there’s going to be a fiscal crisis for New York to reasons increased spending for a pandemic, unemployment, fewer people working, and flight off high-income taxpayers.

I heard the 1% of taxpayers in New York city accounts for New York state was when it comes for about 50% of revenue. If these folks move to Florida that’ll have a very significant impact on the ability of New York City to provide basic services. Then, of course, it depends on policy response, depending on who wins the election in November.

Maybe the best thing you can buy right now is a distressed hotel at really rock bottom prices. This is what KKR is doing on the debit side. They were buying recently some commercial mortgages at 30 cents on a dollar. So potentially that could be great investments.

Part of the reason that impact in commercial real estate is somewhat delayed because there are long-term leases. Of course, there’s a forced merger that has been debated. To what extent this lease can be broken? I think the bigger thing on the commercial state would be in few years when some of these leases expire and even imagine a big company deciding to not renew the lease in Manhattan.

Rent Collection

So right now the rent collection is fine. What we should really track very carefully is rent renewal. And I think my question really touches on how you expect those to change the economy. So of course cap rates are affected by a bunch of things. Low rates tend to lower the cap rates and increase the values, on the other side, we have an increase in risk and drop in growth.

And my general perception is the commercial real estate market would experience some decline in property values, potentially bigger than the housing sector.

Big Negative Impact in the House Insurance Markets

There’s a question about a big negative impact in the house insurance markets.

We kind of discuss it. There’s certainly concern that you, this forbearance translate into permanent delinquencies. We could be in trouble. Yeah, the demands of more space. Could it be certainly yes, for sure? But if you, you know, what I, what I was mentioning you can, if the pandemic persists for a few years there could be more demand for space, especially from time companies don’t have a presence in top markets.

It depends on some of the regulatory response, you know, and it could be that there was an impact on the lease. Even pandemic gets over. We might have another pandemic and people might just say, I need more space. I want my own bathroom.

Persistence of Beliefs

So again, I want to come back to this idea of persistence of beliefs. Even if say we have a pandemic, maybe workers would get more space would it be against, of being cramped up again. And they would say, look sure the pandemic is over, but we don’t know, maybe it will occur. And I really need more space. I really want to have more space to really work and to act as a kind of a precautionary thing.

Even if this pandemic goes over, maybe we entered an area, this risk, maybe it’s quite recurrent. So as a precautionary measure, companies might actually provision more space for workers. Do different cultures, moratorium, eviction impact a long-term investment in housing at the lower end of the market?

I’m quite concerned about this as well, because both on multifamily, the concern is that as far as I know on the multifamily for lower-income households, rent collection is much worse. There could be considerable concerns, whether you’ll be able, able to collect this range.

And yes, that, to your point, I am also concerned about that. That false might be unwilling to develop multi-family for lower-income households thinking that there’s forbearance a rent eviction moratorium, I think might mean lower cashflow collections in crisis. So that could have an impact.

How Will Treasury Meet the Law Affect Real Estate?

How will treasury meet the law affect real estate? So the obvious thing, the effect of real estate on the value of real estate properties because they hurt cap rates. And they also have a refinanced finance real estate properties at a much lower level.

So, for example, if you’re an operator of real estate and treasury rates are lower you can now refinance it at a much lower cost. Of course, the cost is higher because of the pandemic, but the cost would be even higher if treasury rates were not so low.

What I’ve done at the center for the retail shopping mall space. One of your alternatives is to convert them into warehouses, to think Amazon taking greater shopping quality and converting it into essentially a warehouse in another warehouse.

Other alternatives you could think of as converting some of them into office spaces, some sort of social areas. You know, I can make a big gym with a lot of socially distant space, Hasker places and so on. If you look at any parameters that indicate future office vacancy rate, I did concern leading indicators.

So first of all, the rent collection of course is low on the retail side. There’s a very big string of bankruptcies and retail closing. So this will hurt the office space. Rent collection is, is fine. Some indicators suggest some dropping the renewal of leases, but it’s kind of too early to say.

Thank You

Listen, Thank you so much to all of you for reading this complete article. I really appreciated having an opportunity to present to you, especially want to give a warm welcome to all of you. Again, I wish all of us all the best and hopefully, we’ll have a quick recovery. And just in the interest of time, let me finish this way, being our, and if you have any questions or you want to get in touch, feel free to comment, and come on Instagram. Share this post, it will motivate me to create more posts like this for free.

I have not checked in here for a while since I thought it was getting boring, but the last several posts are great quality so I guess I’ll add you back to my everyday bloglist. You deserve it my friend 🙂

Very interesting topic, thanks for posting.

As a Newbie, I am permanently searching online for articles that can benefit me. Thank you

You are a very intelligent person!

Very interesting points you have noted, appreciate it for posting. “History is a cyclic poem written by Time upon the memories of man.” by Percy Bysshe Shelley.

Studies have shown between 1% and 20% of people who test positive end up hospitalized, depending on age and underlying complications. Doctors are just beginning to study the long-term effects of COVID-19 in those patients, but even less is known about people who don’t end up in the hospital.